view gallery

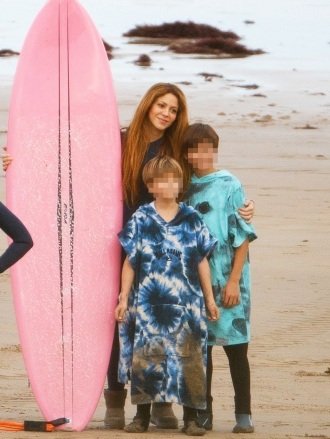

Late November isn’t usually a time for surfing in the northern hemisphere, but it is when you are Shakira, You make time for the beach. On Wednesday (November 30), Shakira, 45, took her sons – Milan9 and Sascha, 7 – to the beach in Cantabria, Spain. The singer wore a navy blue wetsuit to stay warm in the cool ocean waters, while her boys wore black wetsuits when out in the waves.

This beach getaway comes amid Shakira’s ongoing $14 million tax fraud case. The Colombian singer is accused of “failing to pay income taxes to the Spanish government between 2012 and 2014,” per The New York Times. Prosecutors claimed Shakira spent more than half of each year in Spain between 2012 and 2014 and allegedly used a pre-established “corporate framework” to hide income and assets during those years.

Spanish law states that those who live in the country for six months – 183 days or more – must pay taxes. Spanish domestic tax law uses three criteria to assess whether an individual is a resident or not: “physical presence, center of economic interests and whereabouts of spouse and children”, per NYT. Shakira dated a Barcelona FC player for more than a decade Gerard Pique, until they announced their split in June.

Shakira has denied all allegations and has reportedly paid the €14.5million that Spain’s finance ministry claimed she owed. “First of all, back then I didn’t do 183 days a year at all,” Shakira said in one ell Interview. “I was busy fulfilling my professional obligations around the world. Second, I paid everything they said I owed even before they filed a lawsuit. To this day I owe them nothing. And finally, I was advised by one of the four largest tax firms in the world, PricewaterhouseCoopers, so I was confident from day one that I was doing things right and transparently.

“Shakira is a taxpayer who has always demonstrated impeccable tax record and has not had tax problems in any other jurisdiction,” her legal team said in a Nov. 25 statement. “Without solid evidence to support the charges against her, she has been subjected to criminal and media harassment using unacceptable methods to tarnish her reputation and force her to reach a settlement.”